If you’re an employer in the United States, you’re likely familiar with Form I-9. Government-issued Form I-9 ensures employers are hiring employees who are legally permitted to work in the US.

Employers are required to use Form I-9 to verify the identity and employment authorization of each new employee hired after November 6, 1986 to work in the US for wages or other remuneration.

The U.S. Citizenship and Immigration Services (USCIS) issued a new Form I-9 on July 17, 2017. Employers can use this new Form I-9 or continue using the current Form I-9 (with a revision date of 11/14/16 N) through September 17, 2017. As of September 18, 2017, employers may only use the new form (with a revision date of 07/17/17 N).

How has Form I-9 changed?

Although many of the Form I-9 changes are technical and not substantive, make sure to comply with all the changes. Failure to use the new form by the September 18 deadline could result in significant fines.

The new version of Form I-9 makes changes to the form’s instructions and the List of Acceptable Documents.

Changes on Instructions:

Employers must complete Section 1 (the employee’s portion of Form I-9) no later than the first day of employment. To clarify this, “the end of” was removed from the phrase “the first day of employment” to remind employers of the deadline.

Instructions were changed to update the name of the Immigrant and Employee Rights Section of the Department of Justice, previously known as the Office of Special Counsel for Immigration Related Unfair Employment Practices.

Changes on the List of Acceptable Documents:

Added the Consular Report of Birth Abroad (Form FS-240) to List C

Combined all certifications of report of birth issued by the Department of State (Form FS-545, Form DS-1350, Form FS-240) into selection C#2 in List C

Renumbered all List C documents except the Social Security Card

What actions should I take as an employer?

1. Start using the new Form I-9 for employees no later than September 18, 2017.

2. Ensure each new employee completes and signs Section 1 of Form I-9 no later than their first day of employment.

3. Review acceptable documents proving the employee’s identity and employment authorization. That includes...

Confirming the documents appear to be genuine and relate to the employee.

Completing and signing Section 2 of Form I-9 within three business days of the employee’s first day of employment. (Note: If you hire a person for fewer than three business days, Section 2 must be completed by their first day of employment).

4. Reverify employment authorization for employees with expiring documents by the expiration date (See here for when reverification is not permitted).

5. Retain and store the completed Form I-9 for three years after the date of hire, or one year after employment is terminated (whichever is later).

The USCIS has also released an updated Handbook for Employers: Guidance for Completing Form I-9 (Form M-274), which incorporates the above changes.

How do the I-9 and E-Verify differ?

According to U.S. Citizenship and Immigration Services, “Form I-9 is the core of E-Verify.”

In sum, E-Verify compares Form I-9 information to government records online, in order to confirm an employee is authorized to work in the US.

Completing Form I-9 is legally required for all employers, whereas participation in E-Verify is voluntary for most employers. Federal contractors and their subcontractors with qualifying contracts that contain the Federal Acquisition Regulation (FAR) E-Verify clause are required to use E-Verify. In addition, some states have E-Verify requirements.

For example, states like Arizona and Mississippi require all employers to use E-Verify, and states like Colorado, Georgia, Missouri, Nebraska, Oklahoma, Rhode Island, and Utah require all public contractors to use E-Verify.

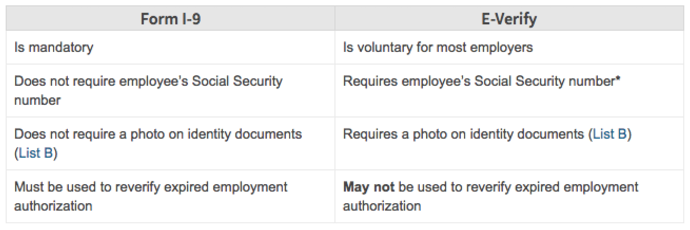

USCIS outlined the following differences between Form I-9 and E-Verify:

How Can Justworks Help?

Justworks helps entrepreneurs run the back-end of their business seamlessly, with payroll processing, HR tools, and access to benefits. Our customers can complete electronic I-9s in the Justworks platform and safely store digital copies of I-9 documents.

Learn more with Justworks’ Resources

Scale your business and build your team — no matter which way it grows. Access the tools, perks, and resources to help you stay compliant and grow in all 50 states.